Who wasn’t talking about this weekend’s New York Times expose of how America’s (and the world’s) most beloved company uses creative accounting and legal tax loopholes to avoid paying its fair share of taxes?

Yes it’s true, Apple fan boys! $AAPL’s U.S. federal income tax rate was less than 10% in 2011, depriving U.S. government coffers of an estimated $2 billion+ and the State of California a hefty amount as well.

I won’t get into the numbers. Better to read Charles Duhigg and colleagues’ thoroughly researched piece of reporting. Here’s a clip from the reporter’s appearance on PBS NewsHour:

I will, however, add my two cents to Apple PR’s response to the allegations. In a nutshell: it fell short.

Sure, the facts as reported by The Times, were not incorrect. Apple did intentionally avoid paying the going U.S. corporate tax rate by taking profits in geographies that legally allow it to do so, i.e.,

“Apple’s accountants have found legal ways to allocate about 70 percent of its profits overseas, where tax rates are often much lower, according to corporate filings.”

What’s more, Apple is hardly the first nor the only company with smart accountants, a fact neatly documented by other major news organizations nearly a year ago, including “60 Minutes,” but with GE as the poster child. Nevertheless, I was surprised by just how defensive the company’s prepared statement sounded:

“Apple, in a statement, said it ‘has conducted all of its business with the highest of ethical standards, complying with applicable laws and accounting rules.’ It added, ‘We are incredibly proud of all of Apple’s contributions.’”

“Apple ‘pays an enormous amount of taxes, which help our local, state and federal governments,’ the statement also said. ‘In the first half of fiscal year 2012, our U.S. operations have generated almost $5 billion in federal and state income taxes, including income taxes withheld on employee stock gains, making us among the top payers of U.S. income tax.’“

|

| Chinese Workers at Foxconn |

It’s almost as if the lawyers and accountants collaborated on this and left the communications pros on the sideline. And it’s not like Apple’s comms team is unaccustomed to dealing with sticky wickets. They did a pretty decent job confronting allegations of sub-par working conditions at its Chinese manufacturing partner Foxconn.

Yet I wasn’t the only one scratching my head at the language Apple chose to try to neutralize the critical tax report in The Times.

BusinessInsider’s Jay Yarow also picked up on it in his piece “Here’s Apple’s Defensive Response To Accusations That It’s Dodging Billions In Taxes” from which he culled a few choice excerpts, adding his own retorts:

- We’ve created 500,000 jobs!

(But it counts the UPS dude who delivers you your iPad as a job created …)

- The vast majority of our global workforce remains in the U.S.!

(Yes, because the people who make iPads aren’t technically Apple employees, they’re Foxconn employees …)

- We donate to charity all the time and don’t talk about it!

(That’s great, but what does that have to do with anything?)

- We’ve paid $5 billion in taxes in the first half of our fiscal 2012!

(Sounds nice, but the NYT says that likely includes taxes from employees, which inflates the number. The whole point of the story is that Apple the company isn’t paying much tax.)

Business Insider goes a step further today by reporting on jobs Apple actually destroyed.

I personally don’t believe that Apple needed to be as defensive, Who’s to blame the company for trying to maximize profit — and shareholder value? Again, nothing the company did was illegal.

|

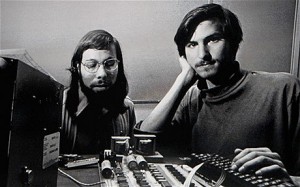

| Wozniak & Jobs (via Reuters) |

Still, with its cultural underpinnings in 1960s counterculture, not to mention its decidedly left-of-center user base, the company might have done better to acknowledge the inequities of the current tax code. It might have couched its public stand in the context of the considerable costs associated with R&D and attracting talent to remain globally competitive.

On the other hand, when the community college down the street from Apple is forced to slash curriculum (and opportunities for young people in need) due to shortfalls in state support, I think Apple might just re-think its corporate social responsibility initiatives. (What are they, anyway?)

Great blog! It’s not often that I comment but I felt you deserve it.

Thanks for share. I’ll definitely comeback.

http://forexforex.pl

Great blog! It’s not often that I comment but I felt you deserve it.

Thanks for share. I’ll definitely comeback.

forex